Streaker Gremlin here to talk about April and May. Spring is here, time for the weather to get nice, which means no more need of this jacket. That's right, its shorts and sundress time; some of the best times to get outside and enjoy the world around us!

April was a rather bland month on my fiscal self, apart from a rather enlarged credit card payment due to my new car's down payment. At this point all of those strange purchases are done, and my credit card bill will back to normal. My portfolio provided me no surprises, but did give some reason to smile with a few increase announcements.

April:

Last

month I brought in a total of $75.32 in dividends ($49.28 taxable,

$25.50 Roth). This is a decrease from last year ($81.76) by -7.88%. Part of this is still due to the lingering cut from

Pengrowth Energy (PGH) and because I dropped Windstream (WIN) last year. This will be last month WIN is mentioned, though I was thankful for its large dividend, its nice to be rid of it too.

In terms of dividend increases, I realized five this month; new purchase Chubb Corp (CB), Realty Income (O), Dr Pepper Snapple (DPS), Coke Cola (KO), and Canadian Imperial Bank of Commerce (CM). CB, DPS, KO, and CM both provided healthy increases in their home currency. O provided its usual quarterly increase, making it the third time I have seen a raise from them this year alone. Five new dividend increases were also released to the press including Apple (AAPL), Unilever (UL), Kellogg's (K), Johnson and Johnson (JNJ), and Kinder Morgan (KMI). Those names almost speak for themselves entirely. Even the lowest increase was 2% (K), still is approximately a cost-of-living increase. AAPL was the leader with an 11% increase, and the remaining increases being around 6-7%. That is the coolest thing, to get those raises for doing nothing any differently!

I did not make any large purchases, but I did add 3 new shares of Microsoft (MSFT) and 2 of KO.

May:

I only owe one future debt - my car. That will begin to get paid off next month, and I plan on staying ahead of the game. Hopefully that is the only thing I have to deal with for a while, though I have more than a sneaking suspicion my wife wants a dog. Don't get me wrong, I love dogs, just don't like paying for them or picking up their poop.

Next

month should produce around $67 in dividends, which is a 10% year-over-year increase. I expect to realize two raises next month, AAPL and KMI. I expect to pick up more shares of KO, UL, K in my Loyal3 account, but probably not MSFT with its recent price run up. In addition, May is a bonus month, meaning I get 3 pay checks instead of the normal 2. This will provide impetus for a large purchase in June or July.

Hope everyone has a great May.

- Dividend Gremlin.

- Long all stocks mentioned, except WIN

Wednesday, April 29, 2015

Monday, April 27, 2015

Advertising...

Viewer Gremlin here. In a past post I discussed putting advertisements on this site, and since then a decision has been made to do this. The main reason is, it would be foolish not to. Running this website is not crazy hard work, but it still takes up some time. So sorry in advance about them, but it had to be done and was only a matter of time. I do promise I will try to put 'better' ads on here, aiming for appropriate to the audience and topics of discussion.

In other news Kellogg's (K) recently announced a small dividend increase of 2% (slow clap), and Apple (AAPL) should have news release today or soon on their plans. I have been looking for AAPL announcements, but have yet to see any. There have been other dividend announcements recently, including JNJ. The full scope of increases and progress along with an outlook for next month will be released shortly, as is tradition.

For next month there will be at least one piece of not related to investing, focusing on summer beer. You might ask yourself why I skipped over spring beer, well its because most of what comes out is not memorable or exciting. Summer is a much better season. I will also be including some workout stuff - for those who like to stay in shape without paying for an expensive gym.

End of month to come soon,

- Gremlin

- Long K, JNJ, and AAPL

In other news Kellogg's (K) recently announced a small dividend increase of 2% (slow clap), and Apple (AAPL) should have news release today or soon on their plans. I have been looking for AAPL announcements, but have yet to see any. There have been other dividend announcements recently, including JNJ. The full scope of increases and progress along with an outlook for next month will be released shortly, as is tradition.

For next month there will be at least one piece of not related to investing, focusing on summer beer. You might ask yourself why I skipped over spring beer, well its because most of what comes out is not memorable or exciting. Summer is a much better season. I will also be including some workout stuff - for those who like to stay in shape without paying for an expensive gym.

End of month to come soon,

- Gremlin

- Long K, JNJ, and AAPL

Wednesday, April 22, 2015

Physical Therapy - Healthcare Sector Qualitative Outlook

Research Gremlin here. Recently Ryan at My Dividend Growth (MDG) put up a great post on some healthcare sector dividend challengers, plucked from David Fish's CCC list. This was an excellent look at four companies that have a ton of promise. I personally liked one, U.S. Physical Therapy, Inc. (USPH), enough to write about their industry. The article at MDG covers basics about the company, and I want to take a broader look at Physical Therapy (PT) (warning this is a long post). Part of this is due to curiosity and that I had almost gone into this profession, but part is also to take a look at healthcare with our changing and aging populace here in the USA.

If you search on Google "Physical Therapy" your first two results are The American Physical Therapy Association (APTA) and the Wikipedia entry for it. Perhaps I get the former because I live close to their main office, but regardless what follows the first two is a series of providers local to my area. There are hospitals and private practices, along with offers for education and other related items.

Focusing on what PT is you get a general definition of "profession that remediates impairments and promotes mobility, function, and quality of life through examination, diagnosis, and physical intervention" (straight from Wikipedia). When searching for the definition you get "the treatment of disease, injury, or deformity by physical methods such as massage, heat treatment, and exercise rather than by drugs or surgery" from Google. So although the definitions by are not identical, they are not terribly far off each other. However, Wikipedia is much more scientific and Google focuses on specific treatments; so let's use both together as a combined definition for what the field does. With that established its important to understand the main groups which will receive this service; those include rehabilitation sports injuries and services for older segments of the population.

Sports injuries (Wikipedia) come in two types, traumatic and repetitive. The former is a sudden injury from dynamic motion or contact, typical of sports such as hockey, football (America), soccer, rugby, etc. The latter is from frequent motion activity such as long distance running, swinging of a racquet (tennis elbow), or throwing of ball (as a pitcher in baseball would). Both types of injuries require PT to rebound from, some need extensive services. The fact is injuries are becoming more common, partially due to our understanding of them. Watch a football game today and you will recognize injuries are treated much faster and with greater care, and rehab can take longer.

This is not only visible in professional sports, but rather a big part of youth sports (ABC News). Look at the statistics on sports injuries across the general population and you see a trend with an increase in occurrence. Each year hospitals see 30,000 high school sports injuries, 500,000 doctor visits occur due to those injuries, and an estimated 2 million injuries are reported at that level. Those numbers are astonishing; what is even more disturbing is approximately 3.5 million kids receive medical treatment for sports injuries. Those are jaw dropping numbers, and if you think that is all, check out that link to the Stop Sports Injuries Organization. These figures are backed up by the American Academy of Orthopedic Surgeons, not pulled out of thin air either. They get even worse if looking at some specific injuries like ACL tears and shoulder / elbow stress (AAOS, Dr. Kocher), which require surgery or time to correct. That interview also brings up many points, chiefly that children are not just miniature adults, their recovery and return should be viewed much differently.

Naturally, the idea is to slow or prevent those injuries. One interesting fact from those links you see above is that the majority, 62%, of injuries occur during practice. This makes sense because most teams practice way more than they play other teams. On top of that, parents and kids are increasingly pushing or pushed into one sport they excel at instead of multiple sports. This ups the chance of repetitive injuries, and in my opinion does a disservice to kids in terms of sports knowledge and experience. I know I learned a playing soccer, baseball, hockey, and basketball - which influence the sports I play today and allow me to see them in a different light than someone who has only played 1 or 2 sports their entire life. This is also pointed out in the ABC News link above, specialization too early is partly to blame for injuries.

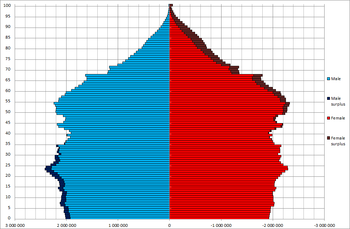

As you can see, sports injuries are on the rise and PT will play a huge part in fixing those problems. Those trends will not change for a while, and neither will the issue of aging in the USA. The literature on the benefits of PT for older adults is astounding, along with the population curve the USA. So first let's look at some information on the population of the US. Our population is growing as evidenced by the last census, and we are about to see something unique. Never before in history has a generation as large as the Baby Boomer's come around and retired or moved beyond age 65. Looking at the chart above you can clearly see where they start at around age 65. Obviously this has many implications, but it also shows that PT for seniors will be in rising demand now for a long time. PT will be likely in higher demand for them too, as many decided to work longer due to the financial pitfall that was 2008-2009.

Looking at that demographics link you see people are living longer, so they will need PT services for more time. That is implicit in the numbers. What is not self evident is that PT will be needed not only for injuries sustained by age, but also to prevent them. The APTA recommends PT to increase balance and prevent falls, which are responsible for 20-30% of moderate to severe injuries for people aged 65 and older. APTA is not alone in this, it is backed up by the journal Physical Therapy and National Institutes of Health.

Between that bubble of retiring seniors and the increasing number of sports injuries you can bet that PT will be more important. Just browse a job board, companies are constantly looking for new PTs and related assistants. My outlook on the industry is that they have a lot of business and work coming their way. It is impossible to ignore this trend in PT and across the general healthcare industry as a whole. Not only will be PT be needed, but also medical devices, pharmaceuticals, and other instruments of health.

For these reasons and the great write up Ryan at MDG had, I've added USPH to my list and continue to watch the healthcare sector. There are ample options in the area right now to buy at a discount, though not USPH, and that industry as a whole should continue provide great dividend opportunities.

What do you think on healthcare?

- Gremlin

Long JNJ, my sole healthcare stock currently.

If you search on Google "Physical Therapy" your first two results are The American Physical Therapy Association (APTA) and the Wikipedia entry for it. Perhaps I get the former because I live close to their main office, but regardless what follows the first two is a series of providers local to my area. There are hospitals and private practices, along with offers for education and other related items.

Focusing on what PT is you get a general definition of "profession that remediates impairments and promotes mobility, function, and quality of life through examination, diagnosis, and physical intervention" (straight from Wikipedia). When searching for the definition you get "the treatment of disease, injury, or deformity by physical methods such as massage, heat treatment, and exercise rather than by drugs or surgery" from Google. So although the definitions by are not identical, they are not terribly far off each other. However, Wikipedia is much more scientific and Google focuses on specific treatments; so let's use both together as a combined definition for what the field does. With that established its important to understand the main groups which will receive this service; those include rehabilitation sports injuries and services for older segments of the population.

Sports injuries (Wikipedia) come in two types, traumatic and repetitive. The former is a sudden injury from dynamic motion or contact, typical of sports such as hockey, football (America), soccer, rugby, etc. The latter is from frequent motion activity such as long distance running, swinging of a racquet (tennis elbow), or throwing of ball (as a pitcher in baseball would). Both types of injuries require PT to rebound from, some need extensive services. The fact is injuries are becoming more common, partially due to our understanding of them. Watch a football game today and you will recognize injuries are treated much faster and with greater care, and rehab can take longer.

This is not only visible in professional sports, but rather a big part of youth sports (ABC News). Look at the statistics on sports injuries across the general population and you see a trend with an increase in occurrence. Each year hospitals see 30,000 high school sports injuries, 500,000 doctor visits occur due to those injuries, and an estimated 2 million injuries are reported at that level. Those numbers are astonishing; what is even more disturbing is approximately 3.5 million kids receive medical treatment for sports injuries. Those are jaw dropping numbers, and if you think that is all, check out that link to the Stop Sports Injuries Organization. These figures are backed up by the American Academy of Orthopedic Surgeons, not pulled out of thin air either. They get even worse if looking at some specific injuries like ACL tears and shoulder / elbow stress (AAOS, Dr. Kocher), which require surgery or time to correct. That interview also brings up many points, chiefly that children are not just miniature adults, their recovery and return should be viewed much differently.

Naturally, the idea is to slow or prevent those injuries. One interesting fact from those links you see above is that the majority, 62%, of injuries occur during practice. This makes sense because most teams practice way more than they play other teams. On top of that, parents and kids are increasingly pushing or pushed into one sport they excel at instead of multiple sports. This ups the chance of repetitive injuries, and in my opinion does a disservice to kids in terms of sports knowledge and experience. I know I learned a playing soccer, baseball, hockey, and basketball - which influence the sports I play today and allow me to see them in a different light than someone who has only played 1 or 2 sports their entire life. This is also pointed out in the ABC News link above, specialization too early is partly to blame for injuries.

|

| (Courtesy Wikipedia) |

As you can see, sports injuries are on the rise and PT will play a huge part in fixing those problems. Those trends will not change for a while, and neither will the issue of aging in the USA. The literature on the benefits of PT for older adults is astounding, along with the population curve the USA. So first let's look at some information on the population of the US. Our population is growing as evidenced by the last census, and we are about to see something unique. Never before in history has a generation as large as the Baby Boomer's come around and retired or moved beyond age 65. Looking at the chart above you can clearly see where they start at around age 65. Obviously this has many implications, but it also shows that PT for seniors will be in rising demand now for a long time. PT will be likely in higher demand for them too, as many decided to work longer due to the financial pitfall that was 2008-2009.

Looking at that demographics link you see people are living longer, so they will need PT services for more time. That is implicit in the numbers. What is not self evident is that PT will be needed not only for injuries sustained by age, but also to prevent them. The APTA recommends PT to increase balance and prevent falls, which are responsible for 20-30% of moderate to severe injuries for people aged 65 and older. APTA is not alone in this, it is backed up by the journal Physical Therapy and National Institutes of Health.

Between that bubble of retiring seniors and the increasing number of sports injuries you can bet that PT will be more important. Just browse a job board, companies are constantly looking for new PTs and related assistants. My outlook on the industry is that they have a lot of business and work coming their way. It is impossible to ignore this trend in PT and across the general healthcare industry as a whole. Not only will be PT be needed, but also medical devices, pharmaceuticals, and other instruments of health.

For these reasons and the great write up Ryan at MDG had, I've added USPH to my list and continue to watch the healthcare sector. There are ample options in the area right now to buy at a discount, though not USPH, and that industry as a whole should continue provide great dividend opportunities.

What do you think on healthcare?

- Gremlin

Long JNJ, my sole healthcare stock currently.

Tuesday, April 14, 2015

Its Spring Time

Hanging out Gremlin here. Been a few weeks since I posted and in terms of investing, my life has been fairly boring. I have added a few new shares of stocks on Loyal3, specifically Microsoft (MSFT) and Coca Cola (KO). I will likely continue this trend into June, where I should be making or close to making one large taxable investment. Either way I am chipping away at my Loyal3 goal, which when realized will see the merger of it into my Sharebuilder account.

Regardless, April has been an exciting month thus far, and its almost halfway done. First, my new car has been exciting to drive and dependable! Second, several unique announcements have been made investment wise, mainly Kraft (KRFT) and GE; their development over the next few years should be exciting to watch and witness how they evolve or devolve. Lastly, spring is finally here. Spring means the final end of season push for the Barclay's Premier League (BPL) is on, NHL Stanley Cup Playoffs, BBQs, and of course the beach. So I will be taking this opportunity to talk about sports of course.

The BPL in my opinion is the most balanced top level flight of soccer in the world, sadly with no salary cap. There are teams that are better than the best BPL team, but those leagues typically miss out on better top to bottom parity. I remain a strong fan of no team, rather a supporter of good games and upsets. Most importantly I love watching the prior champion lose or do as badly as possibly. This past weekend I got a glimpse of that. Chelsea, though I dislike them, has all but wrapped up 1st place and Manchester City (prior champ) lost an important game in its local match (derby) with Manchester United. That is something I relish in sports; this might be due to the fact that all of my American teams have never won a championship. Or because in sports I can be petty... Perhaps that was why I was so excited the Seahawks did not repeat in the Superbowl, in-spite the other team being the Patriots.

Moving on, the NHL playoffs are upon us. To a few it is drawn out affair where for some reason ice hockey ends in the middle of June. To me, its fantastic. My team, the Caps, are in the playoffs and face a good match up in the first round versus the New York Islanders (NYI). For the Caps this is a great match up. They are entering the playoffs with a beast in net , strong scoring, and good defense.

So Let's Go Caps!

How is Spring looking for you?

Going forward I will be doing a qualitative analysis of a health care stock from My Dividend Growth's last post. I might take a similar look at my my current favorite on my watch list and talk some general history, as I am a history nerd / buff.

- Long MSFT, KO, KRFT, GE

- Gremlin

Regardless, April has been an exciting month thus far, and its almost halfway done. First, my new car has been exciting to drive and dependable! Second, several unique announcements have been made investment wise, mainly Kraft (KRFT) and GE; their development over the next few years should be exciting to watch and witness how they evolve or devolve. Lastly, spring is finally here. Spring means the final end of season push for the Barclay's Premier League (BPL) is on, NHL Stanley Cup Playoffs, BBQs, and of course the beach. So I will be taking this opportunity to talk about sports of course.

The BPL in my opinion is the most balanced top level flight of soccer in the world, sadly with no salary cap. There are teams that are better than the best BPL team, but those leagues typically miss out on better top to bottom parity. I remain a strong fan of no team, rather a supporter of good games and upsets. Most importantly I love watching the prior champion lose or do as badly as possibly. This past weekend I got a glimpse of that. Chelsea, though I dislike them, has all but wrapped up 1st place and Manchester City (prior champ) lost an important game in its local match (derby) with Manchester United. That is something I relish in sports; this might be due to the fact that all of my American teams have never won a championship. Or because in sports I can be petty... Perhaps that was why I was so excited the Seahawks did not repeat in the Superbowl, in-spite the other team being the Patriots.

Moving on, the NHL playoffs are upon us. To a few it is drawn out affair where for some reason ice hockey ends in the middle of June. To me, its fantastic. My team, the Caps, are in the playoffs and face a good match up in the first round versus the New York Islanders (NYI). For the Caps this is a great match up. They are entering the playoffs with a beast in net , strong scoring, and good defense.

So Let's Go Caps!

How is Spring looking for you?

Going forward I will be doing a qualitative analysis of a health care stock from My Dividend Growth's last post. I might take a similar look at my my current favorite on my watch list and talk some general history, as I am a history nerd / buff.

- Long MSFT, KO, KRFT, GE

- Gremlin

Subscribe to:

Posts (Atom)